Editor’s Note

2 months ago, Adios launched in Austin, Texas—and it’s been a whirlwind of Goodbye Bags, pick up runs, and learnings along the way. We’ve rehome hundreds of items already, from dozens of Austinites who wanted to say goodbye to their extra stuff—but feel good about it. If you’re in the Austin area—get 50% off in November with code: HEYMAREN and let us know what you think!

🌍 Top News

Sonder says it will liquidate under Chapter 7 after Marriott killed its licensing deal on Nov 9, stranding guests and nuking a one-time darling of the sharing economy (valued at $2.2 billion at its peak). Sadly for guests, Sonder never solved its unit-economic problem—which, as this entrepreneur knows from personal experience 😮💨 is usually a requirement for long-term success. Various reports detail 24-hour eviction emails and chaos at properties as Sonder shutters roughly 9,000 units worldwide (more here).

Urban Outfitters is leaning into resale with Reclectic, a growing chain of URBN outlet-style stores that blend overstock with secondhand. Shoppers can find new-with-tags items, customer returns, and pre-loved pieces from Nuuly’s rental program, organized with clear tagging and heavy women’s apparel assortments. This runs alongside UO’s localized Gen Z store push, signaling a broader URBN bet on value, circular inventory, and discovery in physical retail (more here).

ThredUp is flipping its script and hitting record revenue. ThredUp (TDUP) quietly turned on a peer-to-peer marketplace in closed beta so casual sellers can list directly, with verified accounts, AI-assisted pricing, zero listing fees, and one cart alongside its managed shop. The timing tracks with a rebound: Q3 revenue hit $82.2M, up 34% year over year, which CEO James Reinhart framed as fuel for a “third vector of growth.” (more here).

👉 Winmark keeps winning

Corporate office in Waterford Park, MN

🌉 Background: Winmark, founded in 1988 and based in Minneapolis, is the franchisor behind Plato’s Closet, Once Upon A Child, Play It Again Sports, Style Encore, and Music Go Round, with 1,350+ franchised stores

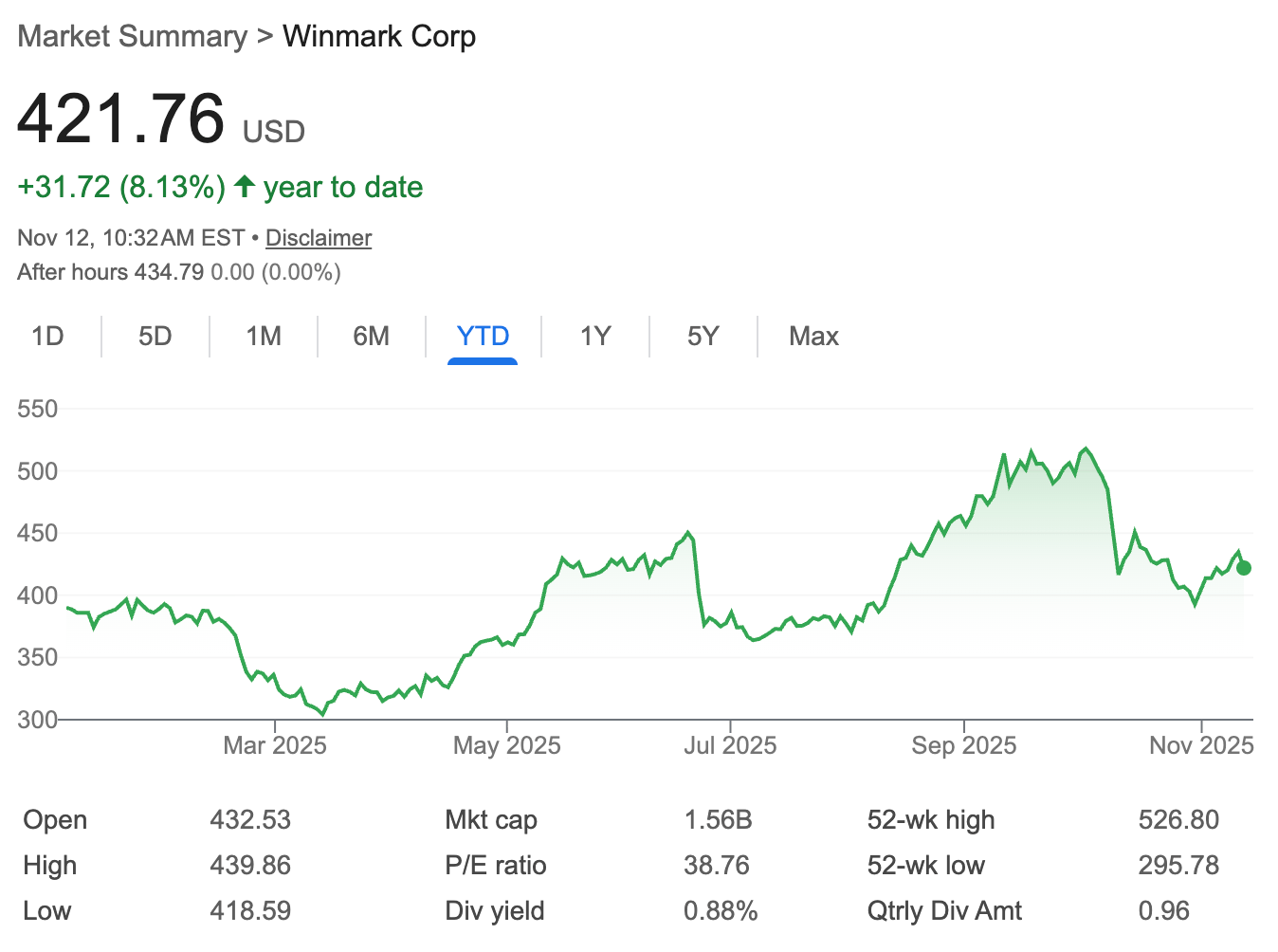

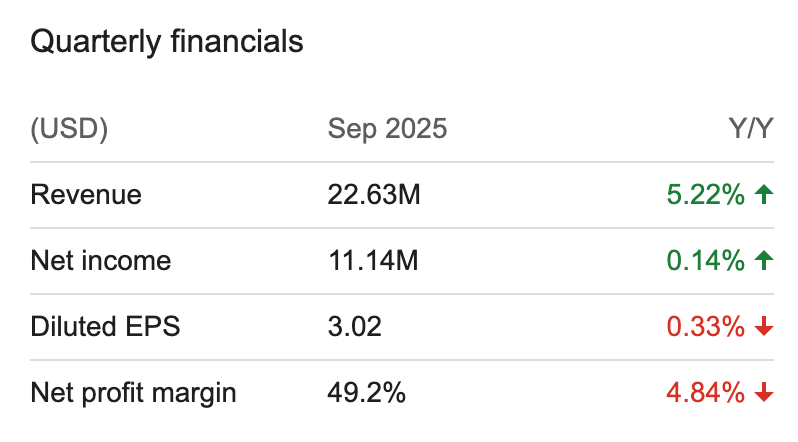

👑 Numbers: In Q3 2025, it posted net income of $11.1M ($3.02 per diluted share) and $31.7M year-to-date ($8.61 per share), and declared a $0.96 quarterly dividend plus a $10 special dividend payable December 1, 2025.

🙈 Edge: Cash-generating, asset-light model with no company-owned stores and recurring royalties, paired with continued growth of resale = winning.

Winmark (WINA) proves that resale can be profitable and asset-light

The U.S. secondhand market grew at a double-digit rate again in 2025, reaching an estimated $56 billion, and surveys show 68% of young people bought secondhand in 2024. The global outlook is expanding too, with projections to $367 billion by 2029, helped by AI discovery tools and price pressure that make thrifting feel smart and values-aligned compared to fast fashion.

That backdrop fits Winmark’s model. The company is a pure franchisor of five resale chains, with 1,350 stores at year-end 2024, and its profitability is driven by recurring royalty revenue rather than owning inventory or stores. In 2024, franchising operating income rose on increased royalties, and the brand mix spans teen fashion, kids, sports, and music gear that align with Gen Z’s thrift habits and budget realities. The result is an asset-light, cash-generative engine that has supported steady capital returns, including a $0.96 quarterly dividend and a $10 special dividend announced for December 1, 2025, positioning Winmark to keep compounding as reuse gains share.

Diving into Winmark’s earnings and impressive net profit margins (above) made me consider other models of sucess in the resale industry. It’s easy to default to procuring secondhand inventory, then reselling it either online or in-person, but as the market grows more profit may be in helping other entrepreneur’s cash-in on the opportunities of reuse themselves 🤔

🤑 Funding

Upway, the refurbished e-bike marketplace founded in 2021, closed a $60M Series C to scale U.S. refurbishment centers and growth

REBEL (formerly Rebelstork), a returns recommerce marketplace launched in 2019, raised a $25M Series B to expand its open-box and overstock platform.

Quino Energy, founded in 2021 to commercialize water-based organic flow batteries, closed a $10M Series A with an option for an additional $6M.

👀 In Case You Missed It…

Starbucks says sorry for viral $30 “Bearista” cup. The cup was reselling for up to $500 on platforms like eBay, with accusations that baristas were hoarding limited stock to flip it after shift.

On the Cornish coast, Ian Falconer’s startup OrCA is turning discarded fishing nets into high-value 3D-printing nylon (used in everything from sunglasses to bike parts), showing how “ghost gear” can shift from costly marine waste to profitable circular-economy feedstock

I’m currently reading Wasteland, which follows author Oliver Franklin-Wallis from landfills and recycling plants to sewage works and scrap yards, uncovering how our trash economy really operates while highlighting the people handling our leftovers and the practical changes that could make the system fairer and cleaner.

Dueces 🤘